Which Race In America Spends The Most Money On Makeup

As people historic period, their spending and saving patterns change. Major life events similar buying a home, getting married or having kids may touch non but the rate at which people save, but also how they classify the coin that they do spend. Generational cohorts have also demonstrated differences in their financial priorities. For instance, a study from the Urban Plant found that in 2018, millennial homeownership rates were approximately viii percentage points lower than the homeownership rates of Generation Xers and baby boomers when they were the aforementioned age (21 to 37 years old).

In this written report, nosotros looked at how different generations spend money. Using data from the Bureau of Labor Statistics' 2018 Consumer Expenditure report, we considered the iii largest living generations in the Us – millennials (born 1981-1996), Generation X (born 1965-1980) and baby boomers (born 1946-1964) – and their spending according to 11 major categories. Nosotros grouped spending by needs and wants, defining housing, utilities & housekeeping, food, healthcare and transportation as needs and clothes & personal care products, entertainment, reading & education and alcohol & tobacco as wants. We additionally considered other spending on personal insurance and pensions along with miscellaneous expenses. Below, we discuss similarities and differences in 2018 spending across generations for those eleven major categories.

Fundamental Findings

-

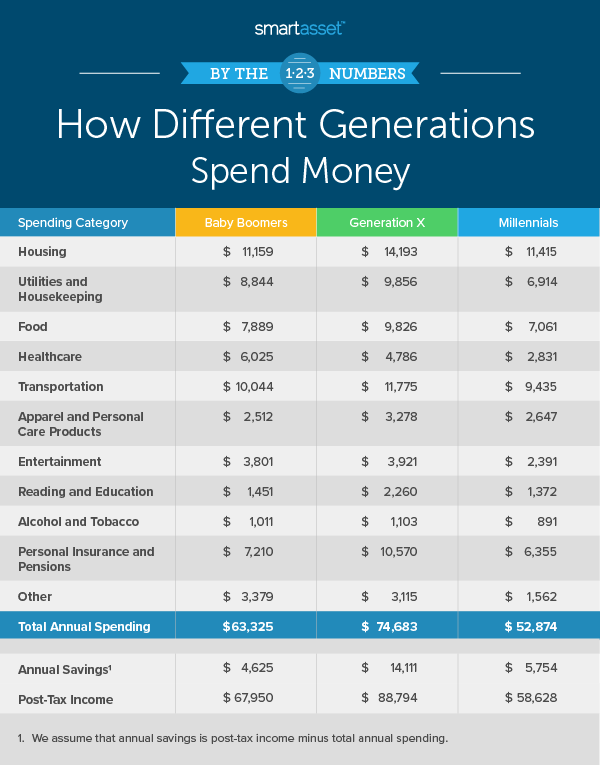

- Gen Xers have the highest post-tax incomes and spend the about. Millennials, Gen Xers and baby boomers had boilerplate post-revenue enhancement incomes of $58,628, $88,794 and $67,950, respectively, in 2018. Of their post-taxation income, millennials spent an average of $52,874 a year, while Gen Xers spent $74,683 and babe boomers spent $63,325 a year. That means Gen Xers outspend millennials and infant boomers past 41% and 18% respectively.

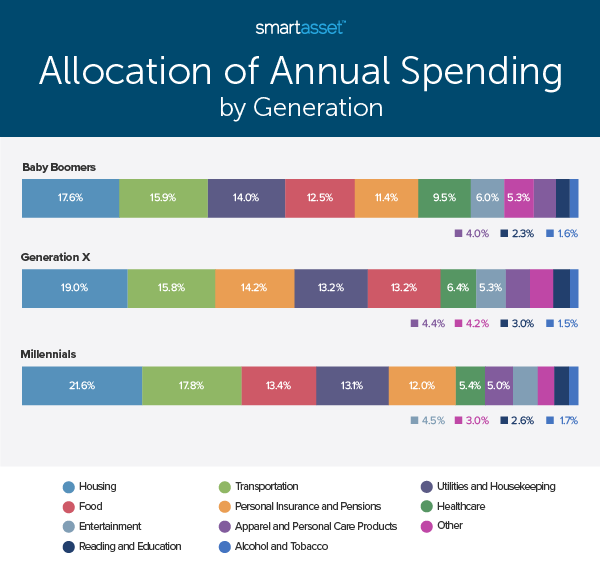

- Housing and healthcare spending vary the most past generation every bit a percentage of overall spending. Housing spending every bit a per centum of overall spending decreases as nosotros look at older groups, with millennials allocating the highest percentage to rent and housing costs and babe boomers the lowest. By contrast, healthcare spending increases with each older generation. On boilerplate, healthcare spending makes up ix.five% of full spending for baby boomers compared to only 5.4% for millennials.

- Savings rates are below suggested levels for all three generations. Bold people from each generation save all of the post-tax income they don't spend in the divers categories, We constitute that millennials and baby boomers both salve less than 10% of their post-tax income, while Generation Xers save almost 16%. Those are all below the recommended savings rate of twenty%, according co-ordinate to a l/30/20 upkeep plan.

Spending on Needs

Housing

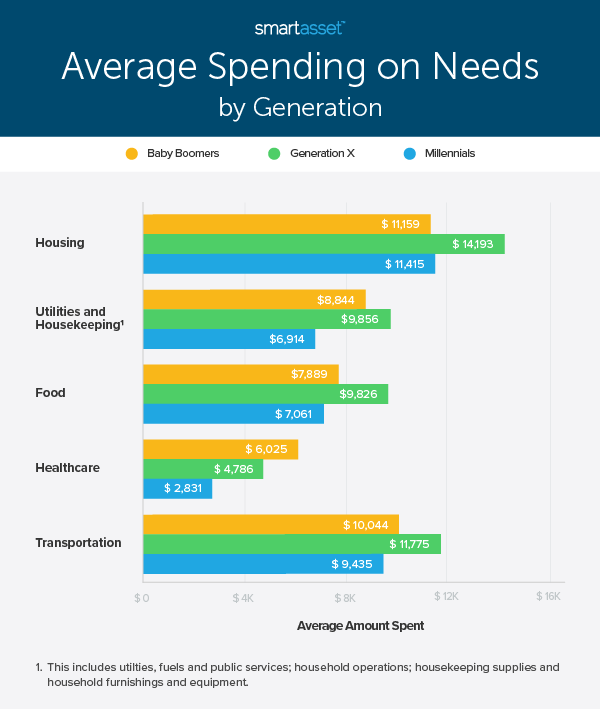

Millennials are less likely to be homeowners than Gen Xers and baby boomers. Census Bureau data shows that the nether-35 homeownership rate was 33.7% in 2018 compared to the national average of virtually 67%. Percentage-wise, millennials dedicate more of their annual spending to housing than any other generation does. Housing makes upwardly almost 22% of annual expenditures for millennials relative to about 19% for Gen Xers and 17.6% for babe boomers. In gross terms, millennials and infant boomers both spend slightly more than $11,000 annually on housing, while Generation Xers spend about $xiv,200.

Utilities & Housekeeping

Utilities & housekeeping spending includes the following: utilities, fuels and public services; household operations; housekeeping supplies and household effects and equipment. Babe boomers allocate the greatest percentage of total spending to utilities and housekeeping, 14%. Though millennials only spend about half of their housing costs on utilities and housekeeping, infant boomers' utilities and housekeeping spending is about fourscore% of their housing costs. Specifically, infant boomers spend an average of $eight,844 on utilities and housekeeping relative to the $11,159 they spend on housing in total.

Food

As a pct of annual expenditures, spending on food more often than not increases as we look at the spending habits of successively younger generations. Of the three generations for which nosotros considered information, millennials dedicate the most of their annual spending towards food, at thirteen.four%, while baby boomers classify the least, at 12.five%. Though Gen Xers fall between millennials and baby boomers when comparison food spending to overall spending, they spend the most in gross terms, an boilerplate of nigh $ten,000 per year.

Though we categorized nutrient as a demand, eating out in particular may be considered a want. The BLS Consumer Expenditure Survey distinguishes between spending on nutrient at home and food abroad from abode. Food away from abode includes all meals including tips at fast food restaurants, cafeterias and full-service restaurants along with take-out and delivery. Peradventure expectedly and potentially driving up higher food spending percentages, millennials tend to spend more than on eating out than Gen Xers and babe boomers, according to the information. Almost half of nutrient spending for millennials goes towards food away from dwelling, 47.3%, while babe boomers allocate just 41.7% of their total food spending to eating out.

Healthcare

As people historic period, the incidence of wellness conditions tends to ascension. Unsurprisingly, healthcare spending, which includes health insurance, medical services, drugs and medical supplies, also increases as nosotros look at data for older age groups. Across generations, from millennials to infant boomers, healthcare spending grows in both gross terms and as a percentage of annual spending. Millennials and Gen Xers spend averages of $2,831 and $four,786, respectively, on healthcare, which map to 5.4% and 6.iv% of their total spending. Infant boomers, non all of whom were yet eligible for Medicare in 2018, spent the most – $half dozen,025, or about 9.5% every bit a per centum of their full spending. Healthcare has the widest range of spending by generation, iv.i%, surpassing housing which has a range of 4.0%.

Transportation

Transportation expenses include vehicle purchases, vehicle insurance, gas and oil and public transportation fares. Transportation spending varies significantly less beyond generations than healthcare spending. In gross terms, average annual transportation spending for each of the three generations is near $ten,000 – more specifically, at $9,435 for millennials, at $11,775 for Generation Xers and at $10,044 for infant boomers. Though equally a percentage of almanac spending, transportation spending decreases with older age groups – from 17.8% for millennials to 15.9% for infant boomers – the range across generations is much smaller here, at less than 2%, than the range of healthcare spending, which spans more than than 4%.

Spending on Wants

Apparel & Personal Care

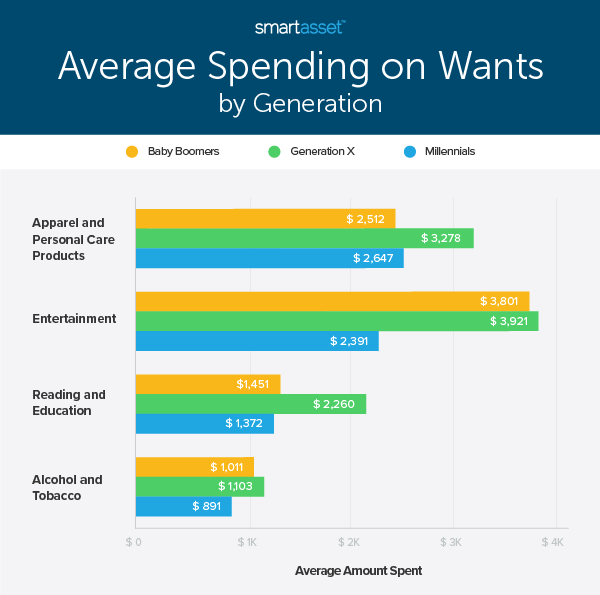

In the category of wants, millennials classify a college percentage of their full spending on dress & personal care than other generations exercise. BLS data shows that millennials allocate nigh 5.0% of their spending to clothes, personal intendance products and personal intendance services relative to four.iv% by Gen Xers and four.0% by infant boomers. In gross terms, millennials spent an boilerplate of well-nigh $2,600 on dress & personal care in 2018.

Amusement

Though millennials have gained a reputation for their spending on experiences, average millennial spending on entertainment is near $1,500 lower than that of each of the other two generations nosotros examined. In 2018, millennials spent an average of $2,391 on amusement, while Gen Xers and baby boomers spent an average of $iii,921 and $3,801, respectively. As a pct of overall spending, millennials still lag behind Generation X and baby boomers. About four.5% of almanac millennial spending is dedicated to entertainment relative to 5.iii% of Gen 10 spending and 6.0% of babe boomer spending.

BLS categorizes entertainment spending according to five subcategories – fees and admissions; tv, radio and sound equipment; pets; toys, hobbies and playground equipment; and other entertainment supplies, equipment and services. Across all ages, the majority of entertainment spending goes to the first three – fees and admissions; idiot box, radio and sound equipment and pets. Specifically, about 80% of millennial entertainment spending, 80.seven% of Generation X entertainment spending and 68.4% of babe boomer entertainment spending goes to those three subcategories.

Reading and Didactics

Though spending may be significantly higher for some Americans given the rise costs of higher teaching in the U.S., the average American spent between $1,300 and $two,400 on reading and education in 2018. As a pct of total spending, millennials, Gen Xers and baby boomers allocated between ii% and 3% of their annual spending to reading and didactics. Gen Xers spent the most in gross terms, $2,260, and as a percentage of spending, iii.0%.

Alcohol & Tobacco

In gross terms, millennials spend virtually $200 less annually on alcohol, tobacco products and smoking supplies than Gen Xers do and about $100 less than baby boomers exercise. However, every bit a percent of spending, Gen Xers allocate the least, nigh 1.5%, compared to 1.7% past millennials and 1.6% by baby boomers. In fact, alcohol and tobacco spending is the simply category of the eleven we looked at for which Gen Xers allocate the to the lowest degree of their spending of the 3 generations.

Tobacco products and smoking supplies include cigarettes, e-cigarettes, cigars and smoking accessories. The breakdown in spending between alcohol and tobacco is too similar beyond generations; spending on alcoholic beverages is most 1.six times the spending on tobacco products and smoking supplies. Millennials spent an average of $560 on alcohol and $331 on tobacco products and smoking supplies in 2018. By comparison, Gen Xers and baby boomers spent respective averages of $693 and $617 on alcoholic beverages and $410 and $394 on tobacco products and smoking supplies.

Other Spending

Personal Insurance and Pensions

Personal insurance and pensions spending include post-tax income spent on life, endowment, annuities and other personal insurance and retirement, pensions and Social Security. The BLS found that over the by twelvemonth personal insurance and pensions spending increased the most of any major category, rising by 7.8% for all consumer units, from $6,771 in 2017 to $seven,296 in 2018. Gen Xers had the highest average spending on personal insurance and pensions in 2018, roughly $10,500.

Cash Contributions and Miscellaneous

The remaining spending for each generation falls nether the two BLS categories of cash contributions – cash contributed to persons or organizations outside of the consumer unit – and miscellaneous – which includes several subcategories such as bank service charges and credit card memberships. Baby Boomers accept both the largest gross corporeality, $3,379, as well equally percentage of their spending in this category of the iii generations, at five.3%.

Savings

Nosotros estimated the average annual savings for each generation by subtracting full annual spending in the 11 defined categories from post-tax income. In 2018, babe boomers saved the least in gross terms of all 3 generations, $4,625, and Gen Xers saved the well-nigh, $xiv,111. Baby boomers had the everyman savings rate of nigh half-dozen.eight% while Gen Xers had the highest, 15.9%. Millennials fell in the eye with a savings rate of 9.viii%.

Information technology is important to notation that spending on pensions and Social Security, a subcategory of personal insurance and pensions, may also exist counted every bit savings. Including pensions and Social Security spending along with the difference between almanac spending and post-tax income, millennials, Gen Xers and infant boomers have savings rates of 20.3%, 27.ii% and 16.five%, respectively.

Data and Methodology

Data for this written report comes from the Agency of Labor Statistics' 2018 Consumer Expenditures Survey. All reported figures are averages per consumer unit of measurement. Consumer units include families, single persons living alone, single persons sharing a household with others while besides remaining financially independent or two of more persons living together who share major expenses. The BLS measures the variability of average expenditures by computing a coefficient of variation, which is the standard error divided by the mean expenditure and is expressed as a percentage. Per BLS recommendations, we did not rely on estimated averages with a coefficient of variation greater than 25.

Tips for Budgeting and Saving

- Make a plan, no matter your generation. The Consumer Expenditure Survey highlights how many Americans are not saving the recommended xx% of their mail-tax income. One of the all-time ways to get your finances nether command is by making a programme. Though generational spending patterns may vary, personal finance is, after all, personal. Take a look at our at our gratis budget estimator to map out your monthly and yearly expenses. Also take a look at our price of living calculator to see how your city compares to others. The cost of living in a city can significantly affect your finances and ability to save.

- Invest early. Past planning and saving early you lot can take advantage of chemical compound interest. Accept a await at our investment calculator to see how your investment can grow over fourth dimension. This will prove a strategic way to grow your coin as your spending and savings priorities change.

- Consider a fiscal advisor. Whether y'all're a millennial starting your professional life, a mid-career Gen Xer or a baby boomer nearing retirement, a financial counselor tin can assist you lot brand smarter financial decisions to exist in better control of your money. Finding the right financial advisor that fits your needs doesn't accept to be hard. SmartAsset'southward costless tool matches y'all with fiscal advisors in your expanse in five minutes. If y'all're ready to be matched with local advisors that volition assist you achieve your fiscal goals, get started now.

Questions most our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/Hispanolistic

Source: https://smartasset.com/checking-account/how-different-generations-spend-money-2020

Posted by: levinespinat.blogspot.com

0 Response to "Which Race In America Spends The Most Money On Makeup"

Post a Comment